After rain comes sun, and after the harvest comes the time to sell your soybeans. As a soybean grower, you probably know everything there is to know about your seeds and which techniques yield the best crops.

But do you know how your soybean crop’s cash price is established? Keep reading to learn more about the basics of soybean closing prices.

Basis

“Basis” is the part of soybean prices that depends on local supply and demand in a given market. It varies from grain terminal to grain terminal and can be positive or negative.

A negative basis means that local supply is significant relative to the overall supply. A positive basis, on the other hand, means that demand is high or that local supply is limited.

Exchange rate fluctuations between the Canadian (CAD) and American (USD) dollar also impact the basis. Knowing which currency is used is important, but you should also be aware of the delivery period and the unit of measurement (bushel or metric tonne).

The futures contract

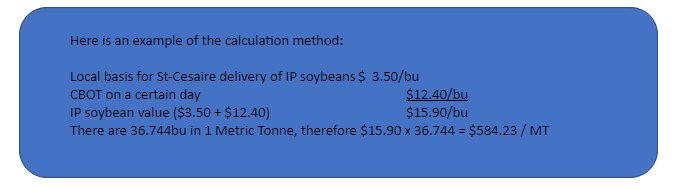

The futures contract is traded on the Chicago Board of Trade (CBOT) in USD and is added to the basis. You can calculate the cash price by adding the basis to the futures contract.

Globex futures prices are linked to the CBOT and fluctuate constantly throughout the trading day.

CBOT’s trading hours are between 9:30 a.m. to 2:15 p.m. ET.

The variety premium

The variety premium is specific to and decided by the buyer. The crop grade of soybeans delivered to the grain centre can affect the value of the premium.

Soybean growers need to know the right questions to ask when they request a price from a buyer. You should find out:

- What grade is the price for?

- What is the delivery period?

- Where is the delivery location?

- What is the basis?

- What is the currency?

Recap: Understanding the basics of soybean closing prices

To sum up, the cash price of soybeans comes down to 3 factors:

- The basis, which fluctuates with supply and demand and the exchange rate

- The futures contract, which is tied directly to the CBOT

- The variety premium, which is buyer-specific (e.g. Prograin)

It’s very important for growers to understand how soybean closing prices work. Of course, this is not always straightforward.

That said, we hope this overview has helped you better understand how soybean cash prices are set.

To learn more about soybeans, have a look through our website’s Blog section.